Expert-Led Financial Analysis Program

Learn directly from seasoned professionals who've navigated decades of market cycles, economic shifts, and investment strategies across global markets.

Next cohort begins September 2025 • Applications open June 2025

Meet Your Expert Instructors

Our program is built around direct mentorship from professionals who've spent their careers analyzing complex financial structures, managing substantial portfolios, and guiding institutional investment decisions.

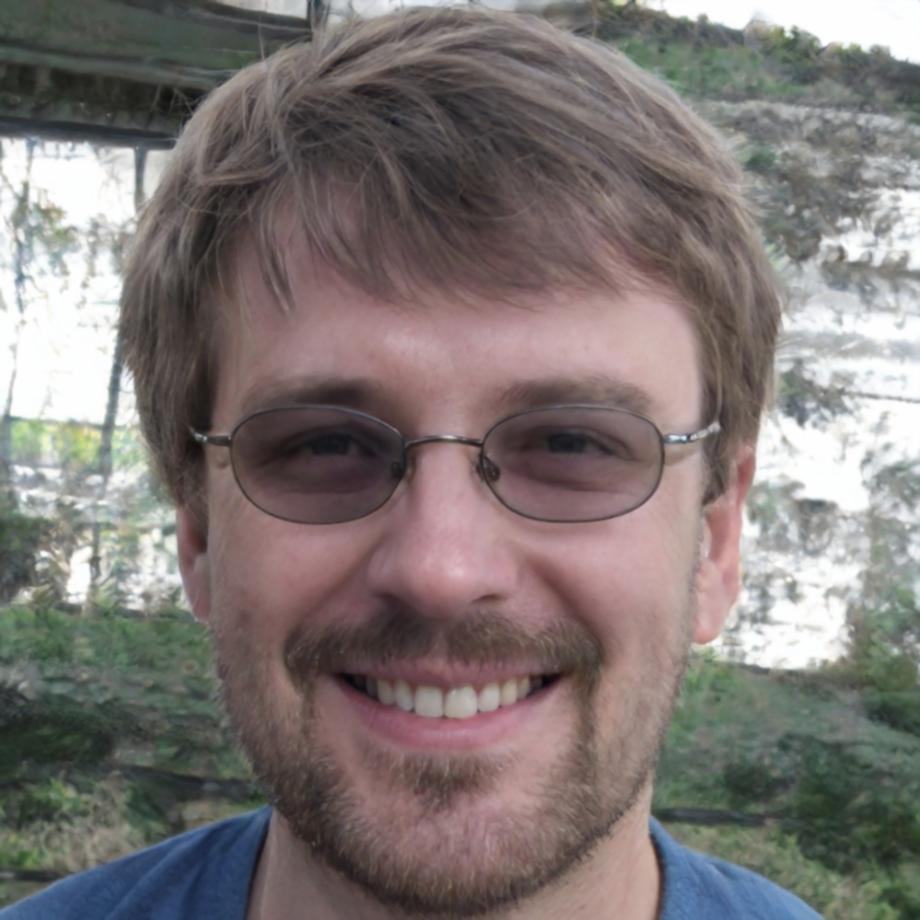

Crispin Montworth

Senior Portfolio Strategist, Former Deutsche Bank

After 18 years managing institutional portfolios worth over £2.4 billion, Crispin brings real-world perspective to financial modeling and risk assessment. He's weathered three major market downturns and has developed frameworks that help analysts spot opportunities others miss. His teaching focuses on practical application rather than theoretical concepts.

Barnaby Wickshire

Investment Research Director, Former Goldman Sachs

Barnaby spent 14 years leading equity research teams and has published over 200 company analyses that influenced billions in investment decisions. He specializes in teaching the art of due diligence – how to read between the lines of financial statements and spot red flags that automated systems miss. His students learn to think like seasoned investigators.

The Practitioner's Approach

We don't teach textbook theories. Our methodology is based on how professionals actually analyze investments, assess risks, and make decisions under pressure. Each lesson connects directly to real situations you'll face in your career.

Case-Based Learning

Every concept is taught through actual deals, failed investments, and market situations our instructors have personally handled. You'll analyze the same companies, using the same methods that shaped million-pound decisions.

Mentored Practice

Small cohorts mean personal attention. Our instructors review your analysis, challenge your assumptions, and share insights they've gained from years of experience. It's like having a senior colleague guide your development.

Professional Tools

Learn with the same Bloomberg terminals, research databases, and analytical software used by investment teams at major institutions. Graduate with hands-on experience using professional-grade resources.